Transfer Money From USA to Portugal Limits: 2026 Complete Guide

If you plan to move money between the United States and Portugal in 2026, it helps to know how things have changed. The rules are a bit stricter now, and both countries want clearer details about where the money is coming from and why it is being sent. These rules are meant to stop illegal activity, but they also affect normal people sending money for simple reasons like rent, family support, or buying a home.

- Understanding Legal Transfer Limits: USA to Portugal in 2026

- U.S. Regulatory Requirements Affecting Money Transfers (IRS, FinCEN, Treasury)

- U.S. Tax Reporting Obligations for 2026 Transfers

- EU and Portugal Compliance Rules Under AMLA (2026)

- Mandatory Verification for Portugal Transfers Above €10,000

- AIMA Requirements for Residency-Related Transfers (D7 & Golden Visa)

- Transfer Provider Limits and Restrictions for 2026

- Delivery Times, Fees, and Compliance Processing (2026)

- Transfer Money From USA to Portugal for Real Estate Purchases

- Transfer Limits for Tuition, Investments, and Family Support

- Reporting Thresholds That Trigger Automatic Monitoring

- How to Prepare Documentation for High-Value Transfers

- Best Strategies for Sending Large Sums in 2026

- Common Mistakes to Avoid When Transferring Money to Portugal

- Final Thoughts

- FAQs

- 1. How much money can I legally transfer from the USA to Portugal in 2026?

- 2. Do I pay tax when transferring money from the USA to Portugal?

- 3. What documents do Portuguese banks need for large transfers?

- 4. Are there transfer limits depending on the provider?

- 5. What are the reporting rules if I hold money in Portugal?

You will see the phrase Transfer Money From USA To Portugal Limits many times because it is the main idea here. Even though there is no “hard limit” on how much you can send, the real limits show up in reporting rules, bank checks, and the documents you must share. Understanding these steps early can save you stress later.

In 2026, the AMLA (the new EU Anti-Money Laundering Authority) is now fully in charge of anti-money-laundering checks across Europe. That means Portugal follows a more unified and stricter system. At the same time, the U.S. also tightened rules through the “One Big Beautiful Bill”, which added a small tax on some international transfers. So, when we talk about Transfer Money From USA To Portugal Limits today, we are really talking about understanding both sides of these rules.

Understanding Legal Transfer Limits: USA to Portugal in 2026

One simple fact surprises many people: there is no legal maximum amount you can send from the USA to Portugal. You could send $5,000 or $5 million. The law doesn’t stop you. But that doesn’t mean there are no limits at all. The limits show up in reporting triggers, bank rules, and compliance checks. These steps are what shape the real Transfer Money From USA To Portugal Limits in everyday life.

Think of it like this: the road is open, but there are checkpoints along the way. These checkpoints don’t block you, but they require information. For example, the IRS or your bank may ask where the money came from or why you’re sending it. Portugal may ask for documents that prove the transfer is clean and legal. These steps help prevent financial crimes, but they can feel confusing if you don’t know what to expect.

A helpful way to look at it is to imagine you are buying a home in Portugal. You might send €10,000, then €50,000, then €200,000. Legally, that’s allowed. But each of those transfers will trigger different checks. So yes, you can send large sums — but you need to be ready for the paperwork.

U.S. Regulatory Requirements Affecting Money Transfers (IRS, FinCEN, Treasury)

When you send money out of the USA in 2026, a few important rules apply. The first one is the 1% federal remittance tax. This tax applies to certain international transfers starting January 1, 2026. It is a small amount, but it still affects anyone sending large sums abroad. That’s why it matters when thinking about Transfer Money From USA To Portugal Limits.

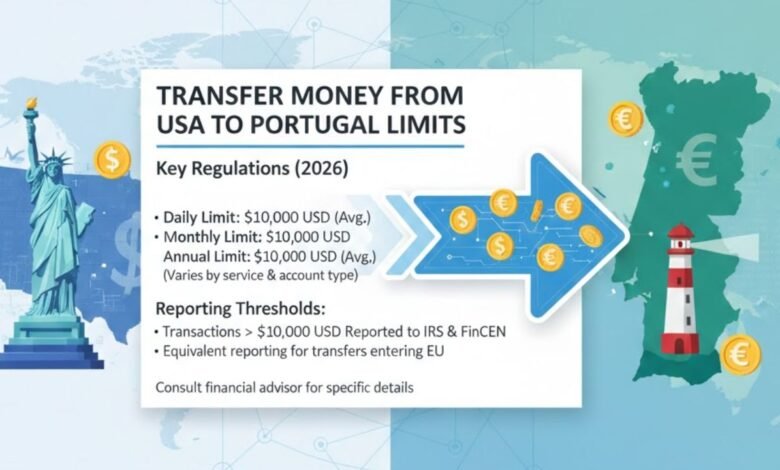

Another key rule is the $10,000 reporting threshold. If you send $10,000 or more, your bank must report it to the Internal Revenue Service through a Currency Transaction Report (CTR). This doesn’t mean you did anything wrong. It is simply a legal requirement. Even if you send $10,001 for something innocent, like helping family or paying for school, the report still has to be filed.

There is also oversight from FinCEN, which monitors international transfers to prevent money laundering. These checks are automatic and done behind the scenes. But they matter because they shape how banks handle your transfer.

U.S. Tax Reporting Obligations for 2026 Transfers

If you send gifts, large payments, or hold foreign assets in Portugal, you may need to file special U.S. tax forms. These forms are not about blocking your transfer. They simply track large movements of money.

For example, Form 709 is required if you give more than $19,000 to any one person in 2026. This applies even if the money is going to someone in Portugal. Many people helping family members are surprised by this rule, so it is important to remember when thinking about Transfer Money From USA To Portugal Limits.

If you own assets in Portugal — such as savings, property, or investments — you might also need to file Form 8938 under FATCA. This happens if your total foreign assets go over $50,000 (or $200,000 if you live abroad). There is also FBAR, which applies if your foreign accounts ever hold more than $10,000 at any point in the year.

Another detail people forget is Form 3520, which you must file if you receive gifts from foreign individuals worth more than $100,000. This can matter if you have family in Portugal sending you money in the opposite direction.

All these forms shape the real Transfer Money From USA To Portugal Limits because they determine what gets reported, what gets taxed, and what stays compliant.

EU and Portugal Compliance Rules Under AMLA (2026)

On the Portugal side, the rules are just as important. Starting January 1, 2026, the AMLA took full control over anti-money-laundering checks across the European Union. This means banks in Portugal must follow much stricter rules.

If a transfer looks large, unusual, or unclear, the bank may ask for proof of the source of funds or the purpose of the transfer. This is not personal. It is simply part of the new EU-wide system. These checks help prevent fraud and illegal activity, but they also mean you should be ready with simple documents like pay stubs, a sale contract, or a real estate agreement.

So when we talk about Transfer Money From USA To Portugal Limits today, we are not talking about a hard stop. We are talking about how these checks shape the path your money takes.

Mandatory Verification for Portugal Transfers Above €10,000

Portugal has one clear rule: if you send more than €10,000 (about $10,800), the bank must verify two things — where the money came from and why it is being sent. This rule applies to both residents and non-residents. It is not about blocking your transfer. It is simply a safety step required under AML laws.

For example, if you are buying a home, the bank may ask for a document called a CPCV — a promissory contract for real estate. If you are paying for university tuition, they may ask for the tuition invoice. These are simple steps, but they surprise many people who expect the transfer to go through instantly.

This makes many people wonder: “Does this mean there are Transfer Money From USA To Portugal Limits I didn’t know about?”

The answer is no — but you must follow the process.

AIMA Requirements for Residency-Related Transfers (D7 & Golden Visa)

If you are moving to Portugal through the D7 visa, Golden Visa, or any other residency plan, you will also work with AIMA. AIMA replaced SEF in 2026 and handles immigration and residency checks, including financial verification.

AIMA requires that residency-related funds be sent to a Portuguese bank account in your own name. This seems simple, but many new residents accidentally send funds to a family member’s account or a joint account. That small mistake can delay their visa approval.

AIMA may also ask for simple proof of income or source of funds when reviewing your application. Again, this does not limit how much you can send. It simply ensures the money is clean and that you meet the program requirements.

Transfer Provider Limits and Restrictions for 2026

Even though there are no government-imposed maximums, each transfer provider has its own limits. These limits shape what people really think of as Transfer Money From USA To Portugal Limits.

For example:

- Wise allows transfers up to $1 million per wire.

- Revolut has no fixed limit, but big transfers require more checks.

- Chase limits online wires to $25,000 per day.

- Bank of America limits online transfers to $3,500 per day or $10,000 per week.

Every provider is different. The trick is choosing one that fits the amount you need to send. For example, property buyers often use Wise or a currency broker because they offer higher limits and cleaner documentation. But someone sending a small amount to family may prefer a simple bank transfer.

Delivery Times, Fees, and Compliance Processing (2026)

When you think about Transfer Money From USA To Portugal Limits, it is not only about how much you can send. It is also about how long the transfer takes and how the bank checks your documents. In 2026, transfer speeds depend on the provider and the amount you send. Smaller transfers often arrive within a day, while larger ones may take longer because they need extra checks.

For example, Wise can send small amounts almost instantly, but a large $200,000 transfer might take one or two business days because of verification. Services like Revolut can also be fast, but big transfers usually need more review time. Banks such as Chase and Bank of America may take three to five business days. Most of this time is spent on safety checks, which are now tighter under the new AMLA rules in the EU.

Fees also vary. Some providers charge a flat fee, while others use a percentage. Wise, for example, often uses a small percentage based on the amount. Larger amounts can have lower rates. Banks may charge higher fees for international wires. All of these small differences matter when you are planning a big transfer, especially during time-sensitive stages like buying a home or paying school fees.

Transfer Money From USA to Portugal for Real Estate Purchases

Real estate transfers are one of the most common reasons people send large sums to Portugal. These transfers are allowed, but they come with extra steps. Portuguese notaries must confirm your money came from a legal source. This means you will almost always need a document that proves where your funds came from. Wise and currency brokers are popular because they provide clean receipts and compliance certificates that banks in Portugal accept easily.

Imagine you are buying a home in Lisbon. You send €20,000 for the CPCV contract and later send €200,000 for the final payment. These transfers are allowed, but each one triggers checks. The bank will ask for proof, such as your CPCV agreement or your sale contract. These steps help keep the process transparent. While it may feel slow, it ensures your purchase goes through without problems.

Because the sums are large, it is smart to plan ahead. You may need to raise your sending limits with your provider or ask your bank to approve the amount in advance. Thinking ahead can help you avoid delays, especially near your closing date.

Transfer Limits for Tuition, Investments, and Family Support

People also send money to Portugal for school fees, business investments, or family needs. These transfers may not be as large as real estate payments, but they still follow the same rules. You must show the purpose of the transfer if the amount is €10,000 or more. For example, a university in Portugal will give you a tuition invoice. You can simply share that with your bank if they ask for it.

When supporting family, the transfer is still allowed, but the IRS may treat it as a gift if it is over $19,000 in 2026. This is when Form 709 comes into play. It doesn’t block your transfer, but you must report it. This is another way Transfer Money From USA To Portugal Limits show up in real life—not as hard stops, but as reporting steps you must follow.

Investments also require clear paperwork. If you are buying into a business or funding a startup in Portugal, your bank may ask for a contract or ownership document. Again, it is not about blocking your transfer. It is simply about showing that everything is clean and clear.

Reporting Thresholds That Trigger Automatic Monitoring

In both the USA and Portugal, certain amounts trigger automatic checks. In the U.S., banks must report any transfer of $10,000 or more to Internal Revenue Service. This report is called a CTR. You do not need to do anything; the bank sends it automatically.

If you hold foreign accounts in Portugal that total more than $10,000 at any moment, you must file an FBAR with FinCEN. If your foreign assets pass $50,000 or $200,000 depending on your situation, you must file Form 8938. These are part of FATCA rules. These thresholds don’t limit how much you send, but they decide what needs to be reported.

On the Portugal side, the AMLA system checks all transfers above €10,000. The bank will want to see proof of the source and the purpose. This is normal in 2026, and most people get through the checks simply by providing the paperwork.

How to Prepare Documentation for High-Value Transfers

If you want a smooth experience, it helps to gather documents before sending large sums. For example, if you send money for a home, keep your CPCV contract ready. If you send money for school, save the tuition invoice. If you send money from the sale of a property in the U.S., keep the sale contract or closing statement.

Banks in both the USA and Portugal may ask for these. They only need simple papers that show your money is legal. Having these ready helps reduce delays and stress. This is especially helpful when the transfer deadline is close, like during a property closing or visa application.

One way to think about it is this: the bank is not trying to stop you. They just want to check the “story” behind the transfer. When everything is clear, the transfer moves fast.

Best Strategies for Sending Large Sums in 2026

If you plan to send large amounts, like $50,000, $100,000, or more, planning ahead is important. The first step is choosing the right provider. Wise is often the easiest for large transfers because the limit is high, and they give you proof of funds. Revolut can work too, but they may need more checks for very large transfers. Some banks allow large daily limits, but you may need to ask them to raise your limit for a short time.

Another strategy is to send the money in stages. Some people send part of the amount first, confirm it arrives, then send the rest. This helps avoid sudden reviews or delays. It also gives you time to provide documents if the bank asks for them.

Remember, Transfer Money From USA To Portugal Limits are not about stopping you. They are about helping you follow the rules and avoid trouble. If you move carefully and prepare documents, the process becomes much smoother.

Common Mistakes to Avoid When Transferring Money to Portugal

One common mistake is not filing the right tax forms in the U.S. For example, someone may send $25,000 to a family member and not realize they must file Form 709. Another mistake is not keeping proof of the source of funds. If you send €20,000 without paperwork, the bank in Portugal may pause the transfer until you show the documents.

Another mistake is sending residency-related funds to the wrong account. AIMA requires funds to be sent to an account in your own name. Sending it to a spouse or friend can slow down your D7 or Golden Visa process.

Some people also assume that providers have unlimited sending power. But each provider has its own limits. Always check your limits before you send money, especially if you are working with tight deadlines.

Final Thoughts

In the end, the idea of “limits” is not about stopping your money. It is about following steps on both sides—USA rules and Portuguese rules. When you understand the reporting thresholds, the documents you need, and the provider limits, the whole process becomes much easier.

You can send any amount you need. You just need to be ready with simple paperwork and choose the right transfer method. In 2026, the system is safer and more organized because of AMLA, IRS rules, and FinCEN checks. If you follow the steps, your transfer will go through smoothly, whether it is for a home, school, business, or family support.

FAQs

1. How much money can I legally transfer from the USA to Portugal in 2026?

There is no legal maximum, but amounts of $10,000 or more trigger IRS reporting, and transfers above €10,000 in Portugal require documents showing the source and purpose.

2. Do I pay tax when transferring money from the USA to Portugal?

A new 1% federal remittance tax may apply to certain outbound transfers in 2026. This doesn’t stop the transfer but affects the total cost.

3. What documents do Portuguese banks need for large transfers?

For transfers above €10,000, banks require proof of income, proof of funds, and purpose documents such as CPCV real estate agreements or tuition invoices.

4. Are there transfer limits depending on the provider?

Yes. Providers set their own limits. Wise allows up to $1M, Chase allows $25,000/day, and Bank of America allows $3,500/day online. These create practical Transfer Money From USA to Portugal Limits.

5. What are the reporting rules if I hold money in Portugal?

If your Portuguese accounts total over $10,000, you must file FBAR. If your assets exceed $50,000–$200,000, you must file Form 8938 under FATCA rules.